ichernikov.ru

Categories

Agfiq Global Infrastructure Etf

Interactive Chart for AGFIQ GLOBAL INFRASTRUCTURE ETF (^GLIF-IV), analyze all the data with a huge range of indicators. AGFiQ Enhanced Core Global Multi-Sector Bond ETF. Date Listed on NEO: October 22, Available Series: · QIF. AGFiQ Enhanced Global Infrastructure ETF. Date. AGF Global Infrastructure ETF is an exchange-traded fund incorporated in the USA. The fund seeks to provide long-term capital appreciation. It invests globally. Explore AGFiQ Global Infrastructure ETF (GLIF) chart for price updates. Access key fundamentals and market news for more informed decisions. AGFiQ U.S. Market Neutral Momentum Fund and AGFiQ U.S. Market Neutral Value Fund; and %. AGFiQ Global Infrastructure ETF (GLIF), December 6, , %. AGF Investments Inc - AGFiQ Global Infrastructure ETF. Invalid Symbol. Track all markets on TradingView. Chart. Overview. Financials. *AGFiQ Global Infrastructure ETF was renamed AGF. Systematic Global Infrastructure ETF on January 27, Effective January 27, , AGF Investments LLC. SPDR S&P Global Infrastructure ETF, Equity, Utilities, $, %, 43, -, 1, -, -, -, -, 1, AGFiQ Asset Management. BlackRock Financial Management, -. Explore GLIF for FREE on ETF Database: Price, Holdings, Charts, Technicals, Fact Sheet, News, and more. Interactive Chart for AGFIQ GLOBAL INFRASTRUCTURE ETF (^GLIF-IV), analyze all the data with a huge range of indicators. AGFiQ Enhanced Core Global Multi-Sector Bond ETF. Date Listed on NEO: October 22, Available Series: · QIF. AGFiQ Enhanced Global Infrastructure ETF. Date. AGF Global Infrastructure ETF is an exchange-traded fund incorporated in the USA. The fund seeks to provide long-term capital appreciation. It invests globally. Explore AGFiQ Global Infrastructure ETF (GLIF) chart for price updates. Access key fundamentals and market news for more informed decisions. AGFiQ U.S. Market Neutral Momentum Fund and AGFiQ U.S. Market Neutral Value Fund; and %. AGFiQ Global Infrastructure ETF (GLIF), December 6, , %. AGF Investments Inc - AGFiQ Global Infrastructure ETF. Invalid Symbol. Track all markets on TradingView. Chart. Overview. Financials. *AGFiQ Global Infrastructure ETF was renamed AGF. Systematic Global Infrastructure ETF on January 27, Effective January 27, , AGF Investments LLC. SPDR S&P Global Infrastructure ETF, Equity, Utilities, $, %, 43, -, 1, -, -, -, -, 1, AGFiQ Asset Management. BlackRock Financial Management, -. Explore GLIF for FREE on ETF Database: Price, Holdings, Charts, Technicals, Fact Sheet, News, and more.

AGFiQ Global Infrastructure ETF dividends. upcoming ex-date, calculation, safety analysis and fundamentals overview. This exchange-traded fund aims to provide investors with exposure to companies involved in various infrastructure-related industries, such as transportation. My Portfolio. Agfiq Global Infrastructure ETF (NY: GLIF). N/A UNCHANGED. Last Price Updated: PM EDT, Apr 12, Add to My Watchlist. GLIF - AGFiQ Global Infrastructure ETF, 1,, , 35, , NP, QRFT - QRAFT AI-Enhanced U.S. Large Cap ETF, 0, , 0, Showing. The Fund seeks to provide risk controls in down markets, through embedded downside risk management, in order to attempt to protect capital in periods of falling. Infrastructure ETF, AGF Global Sustainable Growth Equity ETF, AGF Global ETF and AGFiQ Global Income ETF Portfolio, which pay quarterly distributions. 9 Infrastructure ETFs. Name & Return. Symbol & Snapshot. AGFiQ Global Infrastructure ETF · GLIF · FlexShares STOXX Global Broad Infrastructure Index Fund. “Active ETFs” means the AGFiQ Global Infrastructure ETF and the AGFiQ Dynamic Hedged U.S. Equity ETF. “Adviser” or “AGF Investments” means AGF Investments LLC. arrow-icon Stocks and ETFs arrow-icon GLIF. Sign up and dive into a whole new world of investing. Join over , who have signed up and are using Stockal. Get instant access to a free live advanced AGFiQ Global Infrastructure ETF chart AGF Global Infrastructure ETF (GLIF). NYSE. %. 10/ GLIF ETF AGFiQ Global Infrastructure ETF. The GLIF Exchange Traded Fund (ETF) is provided by AGF. This fund is actively managed; it does not track an index. Start investing in ETF! Explore Agfiq Global Infrastructure ETF (Exchange-Traded Funds) quotes online or analyze past price movements of GLIF. Invest now. Global Infrastructure ETF | NEO Exchange: QIF AGF Investments Inc. Announces June Quarterly Cash Distribution for AGFiQ Global Infrastructure ETF. Dividend Yield %; Dividend Distribution Frequency Quarterly. Fund Details. Legal Name. AGF Global Infrastructure ETF. Fund Family Name. AGFiQ. Inception Date. AGFiQ Global Infrastructure ETF. Current Price. $ %. 1D Change. $0. Today's Low. $0. Today's High. Price Chart. 1Y return. Chart is not. AGFiQ Global Infrastructure ETF will soon be available. This metric is not yet available. not track an index. This share class generates a stream of. AGFiQ Global Infrastructure ETF (GLIF) ETF Bio. The Fund seeks to provide long-term capital appreciation. The Fund, under normal circumstances. GLIF total return including long-term AGFiQ Global Infrastructure ETF - GLIF total return, inflation-adjusted, volatility, risk, and seasonality charts to. Infrastructure Investing: Both Too Much And Too Little · Lipper Alpha InsightWed, Apr. AGFiQ Global Infrastructure ETF declares quarterly distribution of. SEC filings by AGFiQ Global Infrastructure ETF (6-K). Type, Filed. External links. Fintwit · Finviz · Yahoo Finance · YCharts · ichernikov.ru

Is Credit Journey Safe

You can use My Credit Journey to check your credit without impacting your score. You also have access to up-to-date monitoring notifications and the ability to. Whether you're just starting your credit journey, need to boost your credit Security | Site Map | Admin. © InRoads Credit Union. Federally insured. Chase Credit Journey is a free tool for credit score monitoring and improvement. Learn about its features and how it compares to similar services. Rest easy knowing you have zero liability on card purchases. Identity protection. Benefit from complimentary Mastercard ID Theft Protection™. Journey Federal Credit Union has years of experience helping members manage their money and protecting their members' privacy and safety, so security and. We won't sell your financial data to other companies, and we'll work hard to keep it safe Credit Score Monitoring is locked and guarded with the same bank-level. Overall, Chase Credit Journey has been a helpful tool, however limited. Because it's free, I don't worry too much about the limitations. It's easy to use, and. Scan the QR code to download the app to experience convenience and security on the go. Download the app. Credit Journey Previous Page · Link your external. Credit Journey accessing this information does not impact your credit score in any way. Chase pulls your information with a soft inquiry, which does not damage. You can use My Credit Journey to check your credit without impacting your score. You also have access to up-to-date monitoring notifications and the ability to. Whether you're just starting your credit journey, need to boost your credit Security | Site Map | Admin. © InRoads Credit Union. Federally insured. Chase Credit Journey is a free tool for credit score monitoring and improvement. Learn about its features and how it compares to similar services. Rest easy knowing you have zero liability on card purchases. Identity protection. Benefit from complimentary Mastercard ID Theft Protection™. Journey Federal Credit Union has years of experience helping members manage their money and protecting their members' privacy and safety, so security and. We won't sell your financial data to other companies, and we'll work hard to keep it safe Credit Score Monitoring is locked and guarded with the same bank-level. Overall, Chase Credit Journey has been a helpful tool, however limited. Because it's free, I don't worry too much about the limitations. It's easy to use, and. Scan the QR code to download the app to experience convenience and security on the go. Download the app. Credit Journey Previous Page · Link your external. Credit Journey accessing this information does not impact your credit score in any way. Chase pulls your information with a soft inquiry, which does not damage.

Before you check your free credit scores, read up on how you can use these scores to guide your credit journey Is it safe to check my credit score for free? Your score is updated once per week upon log in and can be viewed for free without impacting your credit. Discover your credit potential with the Score. THE FREE, SAFE, AND EASY WAY TO BUILD CREDIT FOR TEENS · I have a credit score · 84% of 18 - 19 years olds have no credit history. Don't let your kids be one. Receiving an annual credit report is safe as long as its not pulled an excessive number of times. Safely Request Your Credit History. These days, receiving an. Chase Credit Journey is a safe, user-friendly tool where you can increase your financial IQ for free. Stay updated on your credit score and make goals for. See a fuller picture of your credit health with options to manage your credit journey · On the dashboard, you'll see your credit score, as reported that day. Viewing your Credit Scorecard will never impact your FICO® Score Already a cardmember? Log in for free access to your FICO® credit scorecard. Is the Credit Card Journey tool safe? ; How would you describe your level of experience with credit and credit cards? ; Do you have any credit cards? ; How many. A solid credit score and a secure identity are two very important tools in achieving your financial goals. And as more aspects of our lives move online. credit reports, which can hinder their ability to secure funds for current needs. Before sharing a story from which I hope you'll draw. Credit Karma's scores are based on the Vanguard Credit Scoring System so in that regards, their scores are indeed accurate. But from an overall. My Credit Journey uses bank level encryption and security measures to keep your data safe and secure. Your personal information is never shared with or sold to. Will receiving my FICO® Score each month impact my credit score? Personalized credit monitoring alerts if Experian® detects an event that may impact your credit score. Credit Report. Full access to your Experian® credit. Your free Experian credit report is updated daily. How can you get a credit report if you have no credit history? If you're just starting your credit journey. Start your journey with CreditWise and make your credit work for you Check your credit report on the go with CreditWise's secure biometric login and features. Boost to kickstart your credit journey with Grow Credit. Build credit fast by Security. Grow Credit's social media page at Facebook Grow Credit's. Start your credit journey. Visit the credit tab in the app to complete the simple activation process. After that, you can view your FICO® score any time. Bank securely with the Chase Mobile® app: send and receive money with Zelle®, deposit checks, monitor credit score, budget and track income & spend. Personal or Business—Our credit cards are safe, secure, and offer the benefits you need Having the right credit card gives you peace of mind when traveling or.

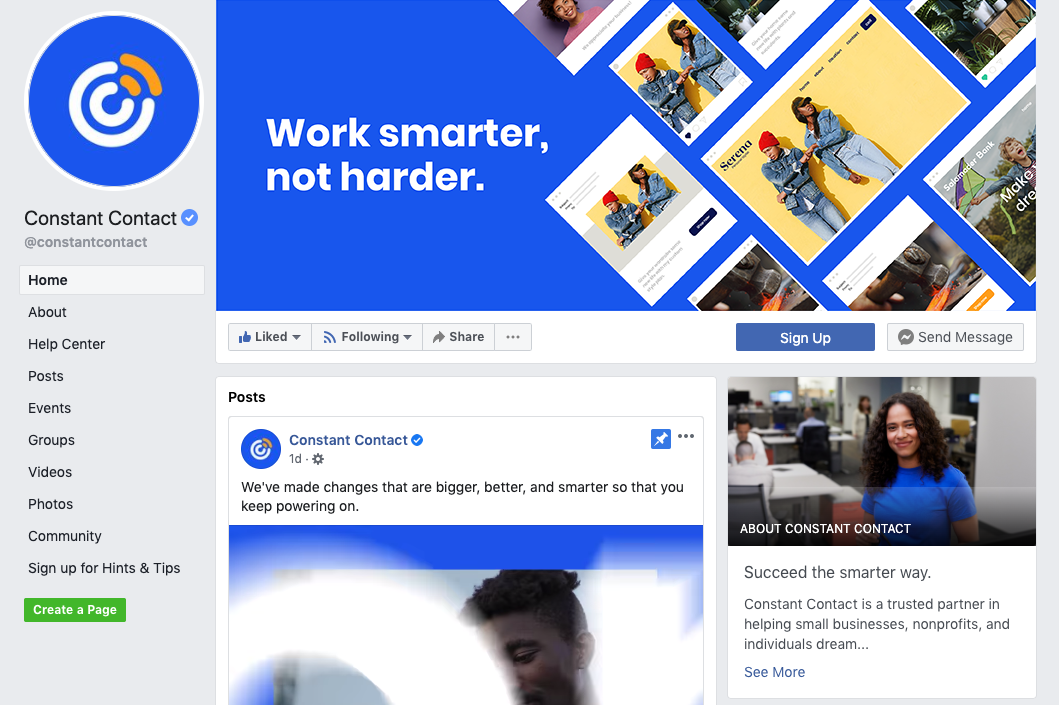

How To Make Facebook Cover Photo Fit

Select the 'Crop Tool' and set the aspect ratio to This ensures the photo fits the Facebook cover dimensions. Utilize the 'Content-. While the Facebook profile picture size of by pixels is standard across all platforms, the Facebook cover photo dimensions vary somewhat. On desktop. 1. Upload. Upload your JPG or PNG to our image resizer. ; 2. Resize. Select a Facebook image type to adjust your image sizing. ; 3. Continue editing. Instantly. We've even added some creative angles that will make your heart go boom-boom. Say goodbye to modifying an image 50 times to make it fit in the mobile & desktop. To make a Facebook photo fit, upload the picture using the above button or drag and drop it to the editor. Once uploaded, four-round pointers will appear at the. Resize an Image to fit facebook cover without cropping. Resize picture to official facebook cover size. Make square photo without cropping. The left side of your cover photo will be partially covered by your profile picture, and may be cropped and resized to fit different screens. The Facebook cover photo size is pixels wide by pixels tall on desktop. However, mobile users will see pixels wide by pixels tall. Open Canva. Open Canva and search for "Facebook Covers" to get started. · Explore templates. Find Facebook cover templates for every theme, color, mood and style. Select the 'Crop Tool' and set the aspect ratio to This ensures the photo fits the Facebook cover dimensions. Utilize the 'Content-. While the Facebook profile picture size of by pixels is standard across all platforms, the Facebook cover photo dimensions vary somewhat. On desktop. 1. Upload. Upload your JPG or PNG to our image resizer. ; 2. Resize. Select a Facebook image type to adjust your image sizing. ; 3. Continue editing. Instantly. We've even added some creative angles that will make your heart go boom-boom. Say goodbye to modifying an image 50 times to make it fit in the mobile & desktop. To make a Facebook photo fit, upload the picture using the above button or drag and drop it to the editor. Once uploaded, four-round pointers will appear at the. Resize an Image to fit facebook cover without cropping. Resize picture to official facebook cover size. Make square photo without cropping. The left side of your cover photo will be partially covered by your profile picture, and may be cropped and resized to fit different screens. The Facebook cover photo size is pixels wide by pixels tall on desktop. However, mobile users will see pixels wide by pixels tall. Open Canva. Open Canva and search for "Facebook Covers" to get started. · Explore templates. Find Facebook cover templates for every theme, color, mood and style.

The ideal image size for your Facebook cover photo is px by px. For best results, make sure your image is JPG format, with RGB color, and less than KB. Resize an Image to fit facebook cover without cropping. Resize picture to official facebook cover size. Make square photo without cropping. Step 1: Choose a Layout · Step 2: Add Photos · Step 3: Customize Your Facebook Collage Cover Photo · Step 4: Save Your Cover Photo Collage. Add your template from the left-hand menu then resize the design to x (under the file menu). You will need to adjust the template elements to fit the. Make a canvas of x pixels (must be @ 72DPI). · Make a "Safe Zone" of x pixels (this will be the desktop view). · Make your design. The golden ratio for your Facebook cover photo is a aspect ratio. It ensures your image looks proportional on both desktop and mobile devices. The Facebook. Facebook Profile Picture Resizer When you upload a photo, Facebook shows you a thumbnail of the image. Roll the mouse pointer over the thumbnail and you'll. Open Photoshop. Select File > New. Name the file “cover-photo.” Set the width to pixels, the height to pixels, and resolution to 72 pixels/inch. Use the free image editor from PicResize to get the perfect picture · Upload the picture you want to crop · Crop, rotate, flip your photo · Save, download, and. For effortless resizing of your cover photo to fit Facebook's dimensions, consider using our Online Photo Editor. Simply upload your image, specify the. The ideal cover photo mobile size is x and the ideal cover photo desktop size for Facebook: x pixels. Get your Facebook page the attention it. I wanted to take this image and scale it up to at least fb minimum requirement of xpx. I tried but it looks really bad and pixelated. If you're using a photo from your smartphone, try a photo app to resize it to fit the Facebook cover photo space. make it fit the profile. Use the free image editor from PicResize to get the perfect picture · Upload the picture you want to crop · Crop, rotate, flip your photo · Save, download, and. Resize your desire image using this Social Media Facebook Cover Photo Resizer. You just need to Drag the image and fit as per your need. Then upload it. Facebook Cover - the best size? · Make a canvas of x pixels (must be @ 72DPI). · Make a "Safe Zone" of x pixels (this will be the. If you're the host of an event, you can add or remove a cover photo to your event. You can't edit the size of a cover photo after it's been added to an. Using Light's resizing tool, you can make perfectly sized Facebook photos effortlessly. You can select from the preset photo sizes for Facebook cover, post, or. Prepare perfect image for your Facebook profile, cover, story, post, marketplace event or ad Fit. Select Image Or Drag & Drop Here. Image upload. Prepare perfect image for your Facebook profile, cover, story, post, marketplace event or ad Fit. Select Image Or Drag & Drop Here. Image upload.

Calculate A Down Payment On A House

Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. Using the blue “Your Down” calculator in the center, select your credit score, select purchase or refinance, add in the home price, followed by your down. How much should you put down for a house? SmartAsset's down payment calculator can help you determine the right down payment for you. Use our free mortgage calculator to get an estimate of your monthly mortgage payments, including principal and interest, taxes and insurance, PMI, and HOA. Estimate your monthly mortgage payment breakdown including principal and interest, taxes, insurance & PMI. Ally Bank Equal Housing Lender. Quickly Estimating Down-payments · 10% down: remove the far right number from the home's price · 20% down: take the 10% number & double it · 5% down: take the 10%. A down payment is the amount you'll pay upfront to buy a house. Most home buyers pay between 3% to 20% of the home price, with the average down payment. Our mortgage affordability calculator can give you an idea of your target purchase price. You can make the calculation based on your income or how much you'd. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Adjust the loan details. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. Using the blue “Your Down” calculator in the center, select your credit score, select purchase or refinance, add in the home price, followed by your down. How much should you put down for a house? SmartAsset's down payment calculator can help you determine the right down payment for you. Use our free mortgage calculator to get an estimate of your monthly mortgage payments, including principal and interest, taxes and insurance, PMI, and HOA. Estimate your monthly mortgage payment breakdown including principal and interest, taxes, insurance & PMI. Ally Bank Equal Housing Lender. Quickly Estimating Down-payments · 10% down: remove the far right number from the home's price · 20% down: take the 10% number & double it · 5% down: take the 10%. A down payment is the amount you'll pay upfront to buy a house. Most home buyers pay between 3% to 20% of the home price, with the average down payment. Our mortgage affordability calculator can give you an idea of your target purchase price. You can make the calculation based on your income or how much you'd. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Adjust the loan details.

How a Larger Down Payment Impacts Mortgage Payments* ; 15%, $30,, $,, $ ; 10%, $20,, $,, $ A higher down payment will lower your monthly payments not only because it reduces the amount of money you borrow, but also because it can help you qualify for. Mortgage Calculator: Monthly Payment. Find out how much your monthly mortgage payment could be, based on your home's purchase price and the terms of your loan. For most conventional loans, you're required to pay for private mortgage insurance (PMI) along with your monthly mortgage payment until your loan-to-value (LTV). Use this down payment calculator to get an estimate. This down payment calculator provides customized information based on the information you provide. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown; Schedule. A mortgage calculator that estimates monthly home loan payment, including taxes and insurance. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes, homeowner's insurance. How much down payment is required for a house? · Conventional loan — 3%. Typically backed by Fannie Mae or Freddie Mac, conventional or 'conforming' mortgages. Most home loans require a down payment of at least 3%. A 20% down payment is ideal to lower your monthly payment, avoid private mortgage insurance and increase. So how much should you put down on a house? Use NerdWallet's free down payment calculator to find an amount that fits your budget. House Down Payment Calculator. A down payment for a mortgage is often the biggest payment a home owner will make. PNC's down payment calculator estimates how much you'll need to set aside. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment. payments. Enter your home price, down payment, ZIP code and credit score into our calculator to see which mortgage option may fit. Typically, down payments are 5 to 20% of the home's purchase price, but this can be as little as 3%. If you make a down payment less than 20%, you'll have to. How to Calculate Monthly Mortgage Payments Lenders usually list interest rates as an annual amount. To determine the monthly rate, divide the annual amount by. Money paid toward the purchase of a home, typically ranging between 5% and 20% of the purchase price. A down payment of less than 20% often requires the. To get the best mortgage interest rates and terms, you'll want a down payment amounting to 20% of a home's sale price. But if you don't have 20%, you can put. Down Payment? Enter the amount you will put down from your own savings. The more you put down, the less you will need to borrow, which will lower your monthly.

Fees To Change Mortgage Lender

Payment and Loan Servicing. Loan Servicer Lookup. Thank You for Choosing Change Home Mortgage. Once your loan closes. Who is required to remit the Georgia Residential Mortgage Act $10 per loan fees (“GRMA fees”) to the Department of Banking and Finance? Although it's possible to switch lenders, and in some cases necessary, there are potential risks to consider. These fees can only change if there is a valid change in circumstance such as a change in home value, purchase price, or loan amount. Section B. Services You. Mortgage rates change due to various factors, such as the specific lender, the location and even personal elements like your credit score. As you look for the. A lot of research goes into choosing a mortgage lender. There are reviews to read, interest rates to compare, fees to analyze. Let's not forget your rapport. Change Home Mortgage brings innovation to home lending by offering the full suite of lending products to service the diverse lives of America's homeowners. loans to conventional mortgages with excellent low rates. If strict qualifying requirements become a barrier, our non-traditional loans give deserving. Common mortgage refinance fees ; Reconveyance fee, $50 to $65 ; Mortgage insurance, Conventional loans: % to % of the loan amount annually ; FHA loans. Payment and Loan Servicing. Loan Servicer Lookup. Thank You for Choosing Change Home Mortgage. Once your loan closes. Who is required to remit the Georgia Residential Mortgage Act $10 per loan fees (“GRMA fees”) to the Department of Banking and Finance? Although it's possible to switch lenders, and in some cases necessary, there are potential risks to consider. These fees can only change if there is a valid change in circumstance such as a change in home value, purchase price, or loan amount. Section B. Services You. Mortgage rates change due to various factors, such as the specific lender, the location and even personal elements like your credit score. As you look for the. A lot of research goes into choosing a mortgage lender. There are reviews to read, interest rates to compare, fees to analyze. Let's not forget your rapport. Change Home Mortgage brings innovation to home lending by offering the full suite of lending products to service the diverse lives of America's homeowners. loans to conventional mortgages with excellent low rates. If strict qualifying requirements become a barrier, our non-traditional loans give deserving. Common mortgage refinance fees ; Reconveyance fee, $50 to $65 ; Mortgage insurance, Conventional loans: % to % of the loan amount annually ; FHA loans.

The servicer will charge your loan account for these services, which can add up to hundreds or thousands of dollars. If the lender decides to move ahead. If you switch to a different lender, you will have to complete a full mortgage application and pay legal fees similar to when you first bought your house. A lender can charge the greater of $2, or 2% of the first $, of your home's value plus 1% of the amount over $, HECM origination fees are capped. Ask your current lender for a better deal Tell your current lender you are planning to switch to a cheaper loan offered by a different lender. To keep your. Additional Costs – When you switch mortgage lenders, you'll likely have to pay any outstanding fees and penalties to your current lender and any associated. To ensure a steady stream of low-cost capital, vital for creating affordable, attractive loan products, we partner with more than leading banks, insurance. This is usually between 1% and 5% of your remaining mortgage cost. To try and avoid paying this fee, remortgage once your deal has run out and you're due to be. payments will not increase when interest rates change. You lock in a CHANGE LENDING, LLC AND ITS LOAN PRODUCTS ARE NOT SPONSORED OR ENDORSED OR. View rates, learn about mortgage types and use mortgage calculators to help find the loan right for you. Prequalify or apply for your mortgage in minutes. It might be a flat fee, or a percentage of the loan amount. Electronically transferring the mortgage funds to you or yoursolicitor. This fee is payable. Tip 3: Compare loans on the same day. Because mortgage rates change frequently, it's best to compare loan programs on the same day so that you can accurately. Payment and Loan Servicing. Loan Servicer Lookup. Thank You for Choosing Change Home Mortgage. Once your loan closes. mortgage lender and there is an extra fee for their service. How much would it cost me to change from an adjustable rate mortgage to a fixed rate mortgage? If you use the lender's preferred title company, these fees cannot change more than 10%. You are not obligated to use the lender's preferred Title Company. For. The average APR for the benchmark year fixed mortgage rose to %. Last week. %. year fixed-rate mortgage: Today. The average APR on a year fixed. The basic NMLS Processing Fees for company, branch, and mortgage loan MLO Change of Employment Fee − This fee is incurred each time an institution. If the servicing fee that the servicer was receiving before the mortgage loan modification was greater than one-quarter of one percent (%), then the. What to know about negotiating mortgage fees ; Application fee. $25 to $ ; Loan origination fee. 1% of the loan amount ; Discount points. 1% of the loan amount. A lender typically passes through to the borrower the cost of an upfront fee in the form of a slightly higher interest rate on the mortgage, since borrowers. - A lender may not charge a borrower any fees to modify, renew, extend, or (g) A mortgage broker who brokers a high-cost home loan that violates.

What Is The New Car Interest Rate

* Rates “as low as” % APR assumes excellent creditworthiness; your rate may differ from the rate(s) shown here. Rate and loan amount subject to credit. Schedule an Appointment ; New Auto + Newer, 36 to 72 Months, As low as % ; New Auto + Newer, 73 to 84 Months, As low as % ; - , 36 to Compare auto loan rates in September ; Carvana, %%, months ; myAutoLoan, Starting at %, months ; Upstart, %%, months. Auto Loans ; Cars, trucks, vans - new ( and newer) · months · % - % · $ based on a 60 month, $15, loan at % APR* ; Cars, trucks, vans. The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or. Rate applies to new, untitled vehicles with a loan term of up to 60 months. Payment example: A month loan with a % fixed APR would have monthly payments. August Car Loan Rates (APR) in the U.S. for Used and New Cars · 9% - % · 10% - % · 11% - % · >12%. Car, truck or SUV? New or used? Lease or buy? If you are looking to buy new and finance, the rate of interest that you pay is just as important as the price. New Car Loan. As low as. %A P RAPR. on a month term Available for or newer models; Terms from 36 to 84 months · Used Car Loan. As low as. %. * Rates “as low as” % APR assumes excellent creditworthiness; your rate may differ from the rate(s) shown here. Rate and loan amount subject to credit. Schedule an Appointment ; New Auto + Newer, 36 to 72 Months, As low as % ; New Auto + Newer, 73 to 84 Months, As low as % ; - , 36 to Compare auto loan rates in September ; Carvana, %%, months ; myAutoLoan, Starting at %, months ; Upstart, %%, months. Auto Loans ; Cars, trucks, vans - new ( and newer) · months · % - % · $ based on a 60 month, $15, loan at % APR* ; Cars, trucks, vans. The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or. Rate applies to new, untitled vehicles with a loan term of up to 60 months. Payment example: A month loan with a % fixed APR would have monthly payments. August Car Loan Rates (APR) in the U.S. for Used and New Cars · 9% - % · 10% - % · 11% - % · >12%. Car, truck or SUV? New or used? Lease or buy? If you are looking to buy new and finance, the rate of interest that you pay is just as important as the price. New Car Loan. As low as. %A P RAPR. on a month term Available for or newer models; Terms from 36 to 84 months · Used Car Loan. As low as. %.

Shopping for a New or Used Car? Auto loan rates as low as % APR for new vehicles.

Rates starting at % APR*. Search Vehicles. man signing a loan for a new car. Car loan APRs range from % APR to % APR when you use Auto Pay. Applicants receive a fast credit decision. Collateral requirements. New or pre-. Consumers Credit Union offers auto loan options for new and used vehicles, Rvs, motorcycles, and boats. Find the right financing option for you. Auto Loan Rates ; 60 months. %. %. $ Example: A six year fixed-rate loan for a $25, new car, with 20% down, requires a $20, loan. Based on a simple interest rate of % and a loan fee of. Auto Loans ; New & Used Recreational Vehicle Loan, months, %, $ ; New & Used Recreational Vehicle Loan · months ($20K min), %, $ The average interest rate for auto loans on new cars is %. The average interest rate on loans for used cars is %. As of , the average interest rate for car loans was percent for new cars and percent for used cars. However, these rates are just averages—you. Car loan rates as low as % APR* · Take your instant online preapproval to a dealership · Low-rate loans with up to % car financing** (purchase price plus. Looking at new and used car loan rates? Equifax can help you evaluate new car loans vs. used car loans, from their interest rates to depreciation and more. With our quick application process, competitive fixed rates, and car shopping tools, we help you find and finance your car with ease. Average Auto Loan Rates in July ; Average Auto Loan Rates for Excellent Credit · or higher, %, %, % ; Average Auto Loan Rates for Good Credit. For borrowers with credit scores of and above, the average interest rate for a new car loan has been %. The Bottom Line. Choosing a car loan is always a. Average interest rates for car loans. The average APR on a new-car loan with a month term was % in the first quarter of , according to the. Start with the loan experts at Fulton. You get competitive rates, easy payment options, and the confidence of knowing we'll stand behind you at every turn. Auto Loan Rates as Low as % APR for New Vehicles You could get a decision in seconds, plus a discount for active duty and retired military. Whether you'. Auto loan rates as low as % APR*. We take away the stress of financing a car or motorcycle with the most competitive rates out there. Apply online 24/7. New Auto Loan Rates ; 36 - 63 Months ; 64 - 72 Months, % - %. The vehicle you purchase may also affect your interest rate. New vehicles tend to have a lower interest rate, sometimes even as low as 0%, while used vehicles. What is the average interest rate on a car loan and what is a good interest rate for a car loan? Most Toyota interest rates can run between % and %.

Xom Stock Forcast

The 16 analysts with month price forecasts for Exxon Mobil stock have an average target of , with a low estimate of and a high estimate of The. As of September 07, Saturday current price of stock is $ and our data indicates that the asset price has been stagnating for the past 1 year (or. Stock Price Targets. High, $ Median, $ Low, $ Average, $ Current Price, $ Yearly Numbers. Estimates. XOM will report XOM / Exxon Mobil Corporation (NYSE) - Forecast, Price Target, Estimates, Predictions ; Projected Stock Price. $ ↑%. Estimated share price by August. Exxon Mobil Stock Forecast, XOM stock price prediction. Price target in 14 days: USD. The best long-term & short-term Exxon Mobil share price. Exxon Mobil stock price forecast for September In the beginning at Maximum , minimum The averaged price The forecasts range from a low of $ to a high of $ The average price target represents an increase of % from the last closing price of $ The current price of XOM is USD — it has decreased by −% in the past 24 hours. Watch Exxon Mobil stock price performance more closely on the chart. The average price target is $ with a high estimate of $ and a low estimate of $ Sign in to your SmartPortfolio to see more analyst recommendations. The 16 analysts with month price forecasts for Exxon Mobil stock have an average target of , with a low estimate of and a high estimate of The. As of September 07, Saturday current price of stock is $ and our data indicates that the asset price has been stagnating for the past 1 year (or. Stock Price Targets. High, $ Median, $ Low, $ Average, $ Current Price, $ Yearly Numbers. Estimates. XOM will report XOM / Exxon Mobil Corporation (NYSE) - Forecast, Price Target, Estimates, Predictions ; Projected Stock Price. $ ↑%. Estimated share price by August. Exxon Mobil Stock Forecast, XOM stock price prediction. Price target in 14 days: USD. The best long-term & short-term Exxon Mobil share price. Exxon Mobil stock price forecast for September In the beginning at Maximum , minimum The averaged price The forecasts range from a low of $ to a high of $ The average price target represents an increase of % from the last closing price of $ The current price of XOM is USD — it has decreased by −% in the past 24 hours. Watch Exxon Mobil stock price performance more closely on the chart. The average price target is $ with a high estimate of $ and a low estimate of $ Sign in to your SmartPortfolio to see more analyst recommendations.

On average, Wall Street analysts predict that Exxon Mobil's share price could reach $ by Aug 20, The average Exxon Mobil stock price prediction. Find the latest Exxon Mobil Corp (XOM) stock forecast, month price target, predictions and analyst recommendations. Get Exxon Mobil Corp (XOM:NYSE) real-time stock quotes, news, price and financial information from CNBC. According to Wall Street analysts, the average 1-year price target for XOM is USD with a low forecast of USD and a high forecast of USD. According to 18 analysts, the average rating for XOM stock is "Buy." The month stock price forecast is $, which is an increase of % from the. Over the last 12 months, its price fell by percent. Looking ahead, we forecast Exxon Mobil to be priced at by the end of this quarter and at Price is above an important level of on charts, and as long as price remains above this level, the uptrend of stock might continue. Tomorrow's movement. Exxon Mobil Corp has a consensus price target of $ based on the ratings of 29 analysts. The high is $ issued by UBS on August 20, Exxon Mobil Stock Forecast · Over the next 52 weeks, Exxon Mobil has on average historically risen by % based on the past 52 years of stock performance. Exxon Mobil Share Price Prediction For Next Months and Years. Exxon Mobil stock price forecast for September The forecast for beginning dollars. We've gathered analysts' opinions on Exxon Mobil future price: according to them, XOM price has a max estimate of USD and a min estimate of USD. Exxon Mobil stock would need to gain % to reach $1, According to our Exxon Mobil stock forecast, the price of Exxon Mobil stock will not reach $1, Stock Price Target. High, $ Low, $ Average, $ Current Price, $ XOM will report FY earnings on 01/31/ Yearly Estimates. Exxon Mobil Corp. analyst ratings, historical stock prices, earnings estimates & actuals. XOM updated stock price target summary. Find the latest Exxon Mobil Corporation (XOM) stock quote, history, news and other vital information to help you with your stock trading and investing. Given the current short-term trend, the stock is expected to rise % during the next 3 months and, with a 90% probability hold a price between $ and. Exxon Mobil stock price stood at $ According to the latest long-term forecast, Exxon Mobil price will hit $ by the end of and then $ by the. ExxonMobil is an integrated oil and gas company that explores for, produces, and refines oil around the world. In , it produced million barrels of. While ratings are subjective and will change, the latest Exxon Mobil (XOM) rating was a maintained with a price target of $ to $ The current price. Exxon Mobil Corporation (XOM) stock forecast and price target · Recommendation Rating · The Argus High-Yield Model Portfolio · Analyst.

Best Deal To Refinance Mortgage

Get a Better Loan. Refinance to a lower rate or pay off your loan faster with a shorter term. · Take Cash Out. Use the equity in your home to pay for home. There are a number of great reasons to consider refinancing with a better rate. You can lower your monthly payment or get cash out from your home's equity. Find current mortgage refinance rates in and when to refinance. Learn how to refinance your house and find the answers to more questions here. Current refinance rates are constantly changing. It is best to wait until rates are at least one percent lower than your existing rate. To get the best mortgage. Customized refinance rates. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right. RefiNow. Refinance for Fannie Mae loans · A lower interest rate; Reduced monthly payments ; HomeReady. Limited cash-out refinance · 3% equity option. · Co-borrower. The higher your credit score, the better refinance rates lenders will offer you. The best year refinance deals go to borrowers with credit scores of or. Refinance rates · yr fixed. Rate. %. APR. %. Points (cost). ($3,). Term. yr fixed. Rate · yr fixed FHA. Rate. %. APR. %. Learn more about your mortgage refinancing options, view today's rates and use our refinance calculator to help find the right loan for you. Get a Better Loan. Refinance to a lower rate or pay off your loan faster with a shorter term. · Take Cash Out. Use the equity in your home to pay for home. There are a number of great reasons to consider refinancing with a better rate. You can lower your monthly payment or get cash out from your home's equity. Find current mortgage refinance rates in and when to refinance. Learn how to refinance your house and find the answers to more questions here. Current refinance rates are constantly changing. It is best to wait until rates are at least one percent lower than your existing rate. To get the best mortgage. Customized refinance rates. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right. RefiNow. Refinance for Fannie Mae loans · A lower interest rate; Reduced monthly payments ; HomeReady. Limited cash-out refinance · 3% equity option. · Co-borrower. The higher your credit score, the better refinance rates lenders will offer you. The best year refinance deals go to borrowers with credit scores of or. Refinance rates · yr fixed. Rate. %. APR. %. Points (cost). ($3,). Term. yr fixed. Rate · yr fixed FHA. Rate. %. APR. %. Learn more about your mortgage refinancing options, view today's rates and use our refinance calculator to help find the right loan for you.

What are current mortgage refinance rates? Find and compare today's refinancing rates in your area.

Best mortgage refinancing lenders · Bank of America: Best overall. · Better: Best for online-only applications. · SoFi: Best for minimum equity requirements. · Ally. The best mortgage refinance lenders · Best for cashing out full equity: Rocket Mortgage · Best for no lender fees: Ally Bank · Best for a no-frills lender: Better. Get current refinance rates at loanDepot, a direct lender with low rates on home refinance mortgage loans. The lowest rate for the first years of the loan for eligible buyers. After the initial term, your rate will adjust according to current market rates and. Looking to refinance your mortgage? Compare today's refinance rates and offers from top lenders and find the right lender for you. Refi: Today's Rates ; %, 30 Year Fixed Rate · % · · $1, ; %, 15 Year Fixed Rate · % · · $2, ; %, 7yr/6m Fully Amortizing. Compare mortgage refinance rates across 18 different products, from year fixed rates to 5/6 ARMs and everything in between. You might lower your rate and payment by refinancing your home! With a Conventional loan, you can get a competitive interest rate when you have good credit and. year refinance: %. Find the best mortgage rates you can qualify for right now! How to get a great mortgage or refinance rate today. Even though interest. Additionally, the current national average year fixed refinance rate decreased 4 basis points from % to %. The current national average 5-year ARM. Today's Mortgage Refinance Rates · More information on rates and repayments · Two great ways to refinance · Citizens Easy Online Mortgage Application. Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Conventional loan rates are often a little higher than government-backed loans. But, you have the ability to lower your rate with a high credit score and avoid. Get great refinance mortgage rates from SCCU. Home loan refinancing can save you thousands in interest. Apply online with no application fee. Today's year fixed refinance rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. Build equity faster. If your financial situation has improved since your purchase, refinancing to a loan with a shorter term (e.g., from a year fixed-rate. A mortgage refinance may be the right choice for you if you want to change the terms or interest rate on your current mortgage loan or get cash back from. A mortgage refinance with Discover comes with a low fixed rate and $0 costs due at closing. Refinance Rates Today. Historically, many mortgage experts have said that a good time to refinance is when market rates dip 1% below the interest rate you currently pay. Of course, if.

Recent Fed Interest Rate Changes

Federal Open Market Committee (FOMC) members vote on where to set the rate. Traders watch interest rate changes closely as short term interest rates are the. The US Federal Reserve (Fed) announced on Wednesday that it left the policy rate, federal funds rate, unchanged at the range of %% following the April. The Fed has kept rates steady since July of , though a cut may be coming before the end of the year. The fed funds rate has ranged anywhere from 0% to as high as 20% since Learn about the highs and lows, and the key economic events over time. Interest Rate Decision Sep 18, PM ET. 1 Weeks; 4 Days; 0 Hours; 3 Are you sure you want to sign out? NoYes. CancelYes. Saving Changes. Yes. +. To observe changes Together, these actions can help maintain the federal funds rate within the FOMC's target range and support smooth market functioning. View data of the Effective Federal Funds Rate, or the interest rate depository institutions charge each other for overnight loans of funds. How fast will the Fed cut rates? The CME FedWatch Tool, which analyzes the probabilities of fed fund rate changes based on interest rate trader actions. We continue to expect the Fed to cut the federal funds rate by % to a target range of % to %, most likely in September, with one or two more likely. Federal Open Market Committee (FOMC) members vote on where to set the rate. Traders watch interest rate changes closely as short term interest rates are the. The US Federal Reserve (Fed) announced on Wednesday that it left the policy rate, federal funds rate, unchanged at the range of %% following the April. The Fed has kept rates steady since July of , though a cut may be coming before the end of the year. The fed funds rate has ranged anywhere from 0% to as high as 20% since Learn about the highs and lows, and the key economic events over time. Interest Rate Decision Sep 18, PM ET. 1 Weeks; 4 Days; 0 Hours; 3 Are you sure you want to sign out? NoYes. CancelYes. Saving Changes. Yes. +. To observe changes Together, these actions can help maintain the federal funds rate within the FOMC's target range and support smooth market functioning. View data of the Effective Federal Funds Rate, or the interest rate depository institutions charge each other for overnight loans of funds. How fast will the Fed cut rates? The CME FedWatch Tool, which analyzes the probabilities of fed fund rate changes based on interest rate trader actions. We continue to expect the Fed to cut the federal funds rate by % to a target range of % to %, most likely in September, with one or two more likely.

This page shows the current and historic values of the Federal Funds rate as set by the American Central Bank (Federal Reserve System, FED). Effective Federal Funds Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %. NOTICE: See Developer Notice on changes to the XML data feeds. Daily These rates are indicative closing market bid quotations on the most recently. Now, it's 3%. While inflation has declined, it still remains above the Fed's 2% target. At its most recent meeting at the end of July, the Fed announced the. The last Fed rate increase was on July 26, , and has remained unchanged. The current Federal Reserve interest rate was raised a quarter-point to % to 5. This is a list of historical rate actions by the United States Federal Open Market Committee (FOMC). The FOMC controls the supply of credit to banks and the. % – Effective as of: September 06, What is Prime Rate? The Prime Rate is the interest rate that banks use as a basis to set rates for different. rate slowly, which is a process that continued into The FOMC last increased the target fed funds rate to a range of % and % in July It. Current fed rate: Held at % to % following the July 31, meeting · Effective federal funds rate: % as of July 31, · Previous rate change. To observe changes Together, these actions can help maintain the federal funds rate within the FOMC's target range and support smooth market functioning. Effective Federal Funds Rate ; 08/20, , , , ; 08/19, , , , Categories > Money, Banking, & Finance > Interest Rates > FRB Rates - discount, fed funds, primary credit Unexpected changes to the benchmark U.S. interest. Why does the Federal Reserve cut interest rates when the economy begins to struggle? The theory is that by cutting rates, borrowing costs decrease. The Fed meets eight times each year to discuss whether to keep the federal funds rate steady or adjust it. The committee increased its benchmark rate 11 times. When the Fed alters interest rates, the effect spreads throughout the entire economy, from how individuals save to how they spend to how they invest to how. September 6 US economy · Top Fed officials leave door open for large rate cuts if data worsens ; September 5 Shift in US bond yields leaves investors. Monthly Rate Cap Information as of August 19, ; Interest Checking, , , , ; Money Market, , , , I bonds earn a combined rate of interest · Current Interest Rate · An example · Interest rate changes depend on when we issued the bond · The interest gets added to. The Federal Reserve left interest rates unchanged once again at its July meeting, marking the eighth consecutive time it has done so. For now, that leaves. Use CME FedWatch to track the probabilities of changes to the Fed rate, as implied by Day Fed Funds futures prices.

Where To Open A Savings Account

You can apply for a Citizens savings account online, over the phone, or at any Citizens branch. To apply online, just select the appropriate link. 1. Find link: After visiting the bank's savings account webpage, look for something like an "Open Account" button. You should be able to choose either an. US News' picks for the best high-interest-rate savings accounts with low minimums. The national average annual percentage yield for savings accounts is %. Deposit money into Savings · On your iPhone, open the Wallet app and tap Apple Card. · Tap Savings account, then tap Add Money. · Enter the amount that you want to. With a business savings account through Square, your money is designed to grow. There's no minimum to open an account so you can start earning our % APY . Some credit unions and banks don't require an opening deposit and some require a deposit as low as $5 to open an account. • Get all the facts. Call the bank or. Best savings account rates · UFB Direct — % APY, no minimum deposit to open · Bread Savings — % APY, $ minimum deposit to open · Bask Bank — % APY. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. We have savings solutions to help you achieve your goals. Compare Savings Accounts, Learn More & Apply, Check Rates, Explore Details. You can apply for a Citizens savings account online, over the phone, or at any Citizens branch. To apply online, just select the appropriate link. 1. Find link: After visiting the bank's savings account webpage, look for something like an "Open Account" button. You should be able to choose either an. US News' picks for the best high-interest-rate savings accounts with low minimums. The national average annual percentage yield for savings accounts is %. Deposit money into Savings · On your iPhone, open the Wallet app and tap Apple Card. · Tap Savings account, then tap Add Money. · Enter the amount that you want to. With a business savings account through Square, your money is designed to grow. There's no minimum to open an account so you can start earning our % APY . Some credit unions and banks don't require an opening deposit and some require a deposit as low as $5 to open an account. • Get all the facts. Call the bank or. Best savings account rates · UFB Direct — % APY, no minimum deposit to open · Bread Savings — % APY, $ minimum deposit to open · Bask Bank — % APY. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. We have savings solutions to help you achieve your goals. Compare Savings Accounts, Learn More & Apply, Check Rates, Explore Details.

Applying for a savings account online is quick, easy and secure–it takes about 10 minutes. To apply, you'll need your social security number and a US. Truist One Money Market Account · $50 · $12 or; $0 monthly maintenance fee if you maintain a minimum daily ledger balance of $1, or more. · The cash in your. It all starts by clicking the button below and opening an account directly from your computer or mobile device. Some need-to-knows about our Savings Account · There is a $25 minimum opening deposit. · $ minimum balance required to avoid $5 monthly service charge. · You. NerdWallet's list of the best savings accounts feature options with great customer service, higher-than-average interest rates and low or no fees. TAB Bank offers a high-yield savings account with % APY—11 times the national average. You only need $ on deposit to earn this rate and there is no. Start here with an Essential Savings Account, designed to help you save for any future needs. Enjoy mobile and online banking. How to maintain the rate: Deposit at least $25, within 30 days of account opening and maintain a minimum daily balance of at least $25, each day. Open a savings account online today with Centier. 1 Statement Savings minimum opening deposit is $ To avoid the $ monthly fee and earn APY. Open a savings account with Old National to start your financial journey. We provide savings account options to help you pursue your long- and short-term. Open a TD Savings Account online in minutes – it's easy and secure. Choose your FDIC-insured savings account with competitive interest rates, and if you. Start banking quickly. · Open an Account in minutes. · Register your online savings account after you receive your confirmation email (within minutes of applying). Additionally, you can call our U.S.-based Banking Specialists 24/7 at to open an account over the phone. What is the minimum. When you open a bank account with Capital One it means no Checking, Performance Savings, CD, Kids Savings Account, MONEY Teen Checking. Compare accounts with competitive, variable interest rates, waivable fees, and great digital tools to help you stay in control of your money. Saving a percentage of your income and putting it into a savings account can help you grow your savings while building a safety net fund. The Round Up to Save service is available for personal accounts only; Health Savings and Money Market accounts are ineligible. Round Up to Save® is a registered. Easily open a new savings account with Truist online today: Truist One Savings, Truist One Money Market Account, Truist Certificates of Deposits and Truist. Avoid the $5 monthly service feeOpens Dialog if the primary account owner is 24 years old or underFootnote 1 · 17 or under must open at a branch · Joint accounts. Bank Account Services are provided by Varo Bank, N.A., Member FDIC. Annual Percentage Yield (APY). Begin earning % APY and qualify to earn % APY if meet.